Remittances to the Philippines have steadily risen for decades. Filipino workers all over the world, and consequently their steady and regular inflows of remittances to the Philippines, account for our homeland’s growing economy. Billions of dollars are remitted every year and contribute to the resilience of the Filipino economy even in the midst of global financial crises.

So it’s not uncommon to hear Filipinos discuss the ways and means of remitting money. We have our different preferred methods: going to the bank to transfer, sending via established centres, and even trying the usual “paki-abot” when someone goes back home… Different methods have different results though. So we decide on the basis of costs (basic fees) and time (how long the transfer will take effect).

I do, as most Filipinos, send money back to the Philippines on a regular basis for a variety of reasons: to support family, pay for investments, send gifts. And like most of you I’ve tried a lot of remittance services, and in doing so, have experienced a lot of headaches and disappointments: either the money does not get there in time, or the amount received is not as expected. Oh, and not to mention the hassle involved in either going physically to the remittance office or maybe calling some call-centre person to assist you in the transaction.

But have you considered an entirely modern way of remitting money?

Here’s an all-too-familiar scenario:

A loved one from the Philippines rings you and asks for emergency money – you need then to send money right away but unfortunately the remittance office is not open on the weekends. And besides, remitting through them takes days before the amount reaches your recipient. You’re torn between choosing to send it at a later time or paying a premium for a “rush” remittance by the bank or an established money transfer centre. With the rising costs of remittance fees, by the time you send through the money, a big chunk of the amount is already reduced!

Have mobile, will transfer…

Then I found this new service – a mobile-centric system that takes away all the middle-person transactions. I control the whole transaction using my own mobile! And guess what – my recipient receives the amount instantly. Yup, that’s right – instantly!

mHits (pronounced em-hits) a pioneering developer and operator of mobile payment services, lets you send money from your Australian mobile phone to Globe and Smart mobile phones anywhere in the Philippines at a very low cost – instantly! Simply send an SMS message and mHITs Remit will take care of the rest!

This means that users of the mHITs Remit mobile remittance service are able to send money to over 70 million mobile phone users in the Philippines. The recipient does not need to have a bank account – all you need to know is their mobile number.

So, I gave mHits a try a few days back, and honestly was pleased how easy it was. I was pleasantly surprised of the convenience of doing it on my own time, the ease of controlling how much I transfer, and the comforting knowledge that I could readily contact my recipient via SMS and confirm if they received it. I didn’t need to contact a middleman and give bank details – I deposit using my own online bank account (or even choose BPAY).

Here’s how:

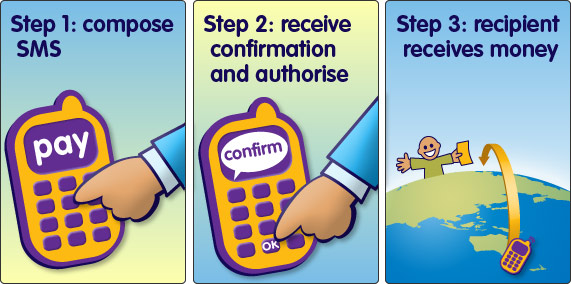

I created an account with them and deposited an amount to send (using BPAY or my online bank account). I then followed a 3-step process.

-

Compose an SMS and send it to a specific mHits number.

-

The system sends back a confirmation text which I need to simply agree to.

- The amount is sent and within seconds, my recipient has it!

How will the recipient encash my remittance? They simply go to a mall, go to a Globe or Smart centre (depending on their mobile carrier) and get their money – in full! How’s that for simplicity and ease? For more information, visit their site here.

So, how do you send money back to the Philippines? Have you also tried alternative ways for remittances? We’d like to hear what your experiences are – good or otherwise. Don’t hesitate to fill up the comment form below.

STOP PRESS!!!!

MHITS REMIT RANKED 1ST BY SEND MONEY ASIA (AUD 500 CATEGORY)

SendMoneyAsia, an independent website that provides a comparison service for money transfer service costs from Australia to Asia, has ranked mHITs FIRST in its AUD 500 category for transfers to the Philippines. MHits is also ranked 2nd in the AUD 200 category. See ranking via the link below.

http://www.sendmoneyasia.org/compare-costs-send-money-australia-china-india-philippines-vietnam.html

SendMoneyAsia is an Australian Government funded website that you can use to compare costs when you send money fromAustralia to China, India, Philippines or Vietnam. SendMoneyAsia looks at the fees and foreign exchange rates charged for money transfer services. The information is free and SendMoneyAsia independent of any money transfer operators.

SendMoneyAsia has been certified by the World Bank for meeting the 12 key minimum mandatory requirements of a national remittance price database. SendMoneyAsia is not a money transfer service. It is a website that allows you to compare the costs for free.

For more information about SendMoneyAsia please see the link below

http://www.sendmoneyasia.org/about-sma/what-is-send-money-asia.html

@sisoy

Thank you for your question.

In doing the mHITs – QP comparison the intention was provide a like-for-like assessment of how mHITs, being a new innovative mobile-based service, stacks up in relation to other providers like QP.

The only information available to undertake a comparison of this nature is the fixed fee. QP quotes its fixed fee in PHP and mHITs in AUD. Hence the conversion of the QP fee into AUD using the QP AUD/PHP exchange rate on the day(29th June 2013).

The total transaction fee charged by mHITs is a fixed AUD 5 plus an FX margin of 1% of the amount sent. It is common market practice for remittance service providers to charge an FX margin, the only difference is that mHITs makes it is transparent by declaring its modest FX margin (1%). Our customers are able to calculate the full cost of doing a remittance transaction before they transact.

The last component of the comparison – the recipient amount – evaluates how much a recipient would have received if the sender remitted AUD 100 on 29th June 2013. The recipient amounts shown (mHITs – PHP 3,776 and QP – PHP 3,750) is inclusive of the mHITs 1% FX margin.

Team mHITs will be happy to provide clarification to any other queries.

I have been using http://www.qwartapadala.com. It is an online money transfer website that sends money to the Philippines from Australia. Qwarta Padala only charges a minimal service fee of 200Php or $4.65 dollars for every money transfer transaction, regardless of how much money you send. It also applies a higher currency exchange rate if you want your money to be sent in Philippines pesos.

why mHITs is different:

mHITs is the only remittance service in Australia offering a mobile to mobile international remittance service. We partner with SMART and Globe in the Philippines.

A simple SMS to your recipient’s mobile number and they receive the money instantly. You don’t need to send the transaction details to the recipient e.g. transaction code, remittance partner etc.

mHITs charges a flat fee of AUD 5 per transaction regardless of the amount sent.

The recipient can withdraw the money from any Smart or Globe outlet right across the country. See link below for the outlet closest to your recipient for both SMART and GLOBE

Smart – Money In Money Out Centers:

http://www1.smart.com.ph/paymentcenters/

Globe – GCASH Local Partners:

http://gcash.globe.com.ph/partners#local

How do we compare*:

mHITs:

Send AUD 100

Service Fee: AUD 5

Recipient amount: PHP 3,776.16

Qwarta Padala (information sourced from website):

Send AUD 100

Service fee(PHP 200): AUD 5.06 (exchange rate 39.5125)

Recipient amount: PHP 3,750

*based on current rates (as at 29 th June 2013)

For more details please visit us at http://www.mhits.com.au/send-money/philippines/

@mHits – it appears that you have overlooked to mention the additional “1% of the amount” on top of $5 service fee, as stated in http://www.mhits.com.au/send-money/philippines/. Care to elaborate this.

I am curious about this service. Has anyone else of you tried this? Anyone from cebu or gensan? Where exactly can the recipients go to get the money?

mHITs Remit partners with Globe and Smart in the Philippines. Both Smart and Globe have local partners located throughout the Philippines where a recipient can cash-out/withdraw money sent from Australia via mHITs. The operations of the local partners are controlled Smart and Globe respectively.

Please see below links to the local partners locations. Using this link you will be able find a Smart or Globe local partner closest to your recipient.

Smart – Money In Money Out Centers:

http://www1.smart.com.ph/paymentcenters/

Globe – GCASH Local Partners:

http://gcash.globe.com.ph/partners#local

ha! baka kamo hindi umabot kapag paki-abot lang! meron din sa western union kaya lang mahal.

This is quite interesting sending money via cellphones… but how secure is it?

mHITs is an extremely secure way to conduct your transactions. Here’s why:

1. All transactions are performed from YOUR mobile phone. To perform any mHITs transaction, you must physically use your mobile phone. This ensures that only you can perform a transaction.

2. All transactions must be personally authorised. Unlike credit card and direct debit systems which allow auto-debiting of your account, every mHITs transaction must be personally authorised. This puts you, and only you, in total control of every transaction.

3. Instant notification of all transactions. Whenever an mHITs transaction occurs on your account, you are notified INSTANTLY by sms.

4. No transactions can be performed via our website. This eliminates the possibility of Internet fraud.

5. Monitoring of transactions. All mHITs transactions are monitored by our fraud prevention team.

6. No credit card details are stored. Unlike credit card systems where details are stored, each mHITs transaction must be performed by an individual. This means that all transactions must be personally authorised each time they occur.