Below is a summary of Superannuation and Other ATO Changes:

Increase of Super Guarantee Rates

From 1 July 2013 – 9.25%

From 1 July 2014 – 9.50%

From 1 July 2015 – 10%

From 1 July 2016 – 10.5%

From 1 July 2017 – 11%

From 1 July 2018 – 11.5%

From 1 July 2019 – 12%

Super payments for employees over 70 years old

From 1 July 2013, the existing age limit for employee super guarantee eligibility will be removed. This means you will need to start making super guarantee payments for eligible employees who are 70 years old or over.

Increase of concessional contributions cap

From 1 July 2013 – $35,000 for 60 years old or over

From 1 July 2014 – $35,000 for 50 years old or over

Self Managed Super Funds (SMSF)

Required to conduct review of fund’s strategy on a regular basis

Required to consider insurance for fund members as part of investment strategy

Required to value fund’s assets at market value for the purposes of preparing financial accounts and statements

Funds to be audited by ASIC Registered SMSF Auditor

Increase of tax-free threshold

From 1 July 2012, the tax-free threshold was increased to $18,200Decrease of low income tax offset

From 1 July 2012, the low income tax offset was reduced to $445

Increase of Medicare Levy

From 1 July 2012 – medicare levy goes up to 2%

Small Business

Claim in tax 100% of your Investments in Plant and Equipment of up to $6,500 per item

Claim in tax first $5,000 of new or second-hand motor vehicle purchased during the year plus depreciation of 15%

If in building and construction industry, you have to report taxable payments to ATO indicating:

-ABN

-Name

-Address

-Gross payment inclusive of GST

-Total GST included

Bank account details required for refunds

From 1 July 2013, when preparing your individual tax returns, you need to include your nominated Australian bank account details when a refund is expected

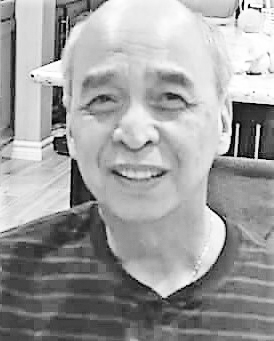

Mike Alvarez, a CPA and Registered Tax Agent, is the director of QA Audit and Tax Services

Leave a Reply