Illegal super schemes usually involve a promoter offering to help you access your super early.

Promoter of illegal super schemes usually:

-Encourage you to transfer your super from your existing super fund to a self-managed super fund (SMSF) to access your super before you are legally entitled to

-Target people who are under financial pressure or who do not understand the super laws

-Claim that you can use your super for anything you want – which isn’t true

-Charge high fees and commissions, and you risk losing some or all of your super to them.

Taking your super out from any super fund early, without meeting a condition of release, or encouraging others to do so is illegal.

Generally, you can only access your super when you reach preservation age and stop working. Currently, in Australia, the preservation age is 55 years old for those born before 1 July 1960. It then increases gradually. For anyone born after 30 June 1964, the preservation age is 60 years old.

There are some special circumstances where you can legally access your super early. These include specific medical conditions or when you are experiencing severe financial hardship. To find out if you can legally access your super early, contact your super fund.

Severe penalties apply for illegally accessing your super early. You cannot claim a deduction for any fee or commission a promoter takes from your super when they help you to roll over or set up an SMSF. You may be required to pay interest and penalties on super you have accessed illegally.

Changes to the law have been proposed, which if passed, will mean that any super you access illegally will be taxed at 45% regardless of your marginal tax rate.

If you illegally access your super early, it is included in your taxable income, even if you return the super to the fund later. If you set up an SMSF and knowingly illegally access your super early, you may incur a fine of up to $340,000 and a jail term of up to five years.

If you are an SMSF trustee, you also incur higher taxes and additional penalties, and can be disqualified if you allowed super to be accessed early from the fund. If you are disqualified, you are unable to operate as a trustee of an SMSF.

As a trustee, if you knowingly allow illegal access to super, you may incur penalties of up to $340,000 and jail terms of up to five years, or fines of up to $1.1 million for corporate trustees.

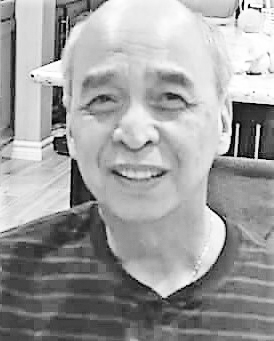

Mike Alvarez, a CPA and Registered Tax Agent, is the director of QA Audit and Tax Services Pty Ltd, a CPA Practice. He is also an ASIC Registered SMSF Auditor. Tel. 02 9628 2933.

Leave a Reply