Subsection 67(1) of the Superannuation Industry (Supervision) Act 1993 (SISA) prohibits a trustee of an SMSF from borrowing money.

However, there are specific exceptions in Section 67 to the prohibition on the SMSF trustee borrowing money. These include where the borrowing is to:

- · Fund a payment to a beneficiary

- · Cover settlement of certain securities transactions

- · Allow the SMSF to acquire an asset under certain limited recourse arrangements, or

- · Fund a payment of the superannuation surcharge

SMSF trustees are required to appoint an approved auditor to audit the financial accounts and statements of the SMSF each year. When conducting an audit, the approved auditor is also required to conduct a compliance audit to ensure the SMSF has complied with the SISA and SISR. Starting with the 2013 financial year, the approved auditor must be an ASIC registered auditor.

Non-compliance with section 67 may expose SMSF trustees to civil penalties. Contravention or involvement in a contravention attracts both civil and criminal consequences and places at risk the SMSF’s status as a complying superannuation fund under the SISA.

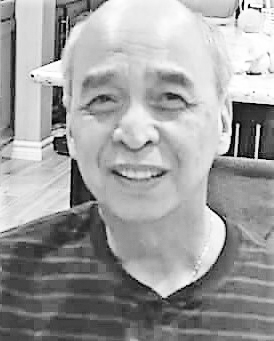

Mike Alvarez, a CPA and Registered Tax Agent is the director of QA Audit and Tax Services Pty Ltd, a CPA Practice. He is also an ASIC Registered SMSF Auditor. Tel. 02 9628 2933.

Leave a Reply